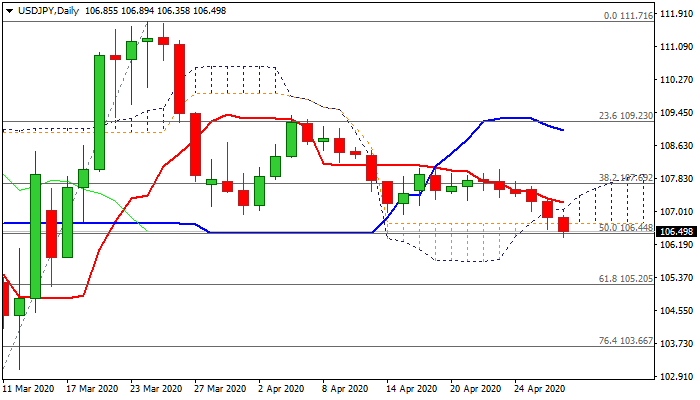

Bears probe again through key supports ahead of US GDP data / Fed

The pair hit new six-week low in European trading on Wednesday, remaining firmly in red after Tuesday’s marginal close below 106.92 former base but failure to close below cracked daily cloud base (106.70).

Fresh bearish extension today broke below cloud base and probed below Fibo support at 106.44 (50% of 101.18/111.71).

The dollar remains at the back foot ahead of today’s key events, US Q1 GDP and Fed policy meeting. Expectations for 4% contraction of the US economy in the first quarter could have strong negative impact on the greenback, with the central bank expected to keep interest rates (lowered near zero to offset negative impact of lockdown) unchanged, but its ready to use all weapons available if the situation worsens.

Technical studies are fully bearish on daily chart and maintain pressure, with close below cloud base needed for fresh bearish signal, which will be confirmed on close below 106.44 Fibo level.

Bears could extend towards 105.20 (Fibo 61.8% of 101.18/111.71) on stronger acceleration.

Upticks need to hold below daily cloud top (107.40) to maintain bearish bias.

Res: 106.70; 106.92; 107.22; 107.40

Sup: 106.35; 106.00; 105.85; 105.20