Upside rejection and subsequent extension lower bring in play risk of recovery stall

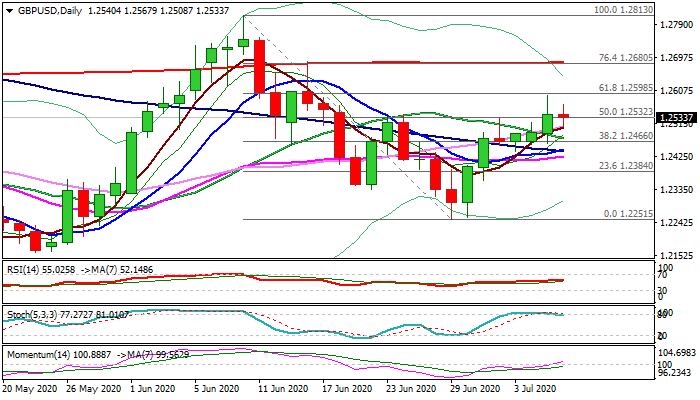

Cable dipped back to 1.2500 zone after hitting three-week high (1.2592) on Tuesday, where the rally, inspired by optimism on EU/UK trade talks, stalled ticks ahead of pivotal Fibo barrier at 1.2598 (61.8% of 1.2813/1.2251 descend), leaving daily candle with long upper shadow.

This could be seen as initial sign that recovery leg on short-squeeze from 1.2251, might be running out of steam.

Broken pivot at 1.2532 (50% of 1.2813/1.2251 / daily Kijun-sen) now acts as key support, with today’s close above here to keep alive hopes of fresh attempts towards 1.2598 Fibo barrier.

Conversely, close below this level would weaken near-term structure and increase risk of top (1.2592).

Res: 1.2567; 1.2598; 1.2653; 1.2680

Sup: 1.2508; 1.2474; 1.2466; 1.2444