Gold remains at the back foot and tests again key $1920 support

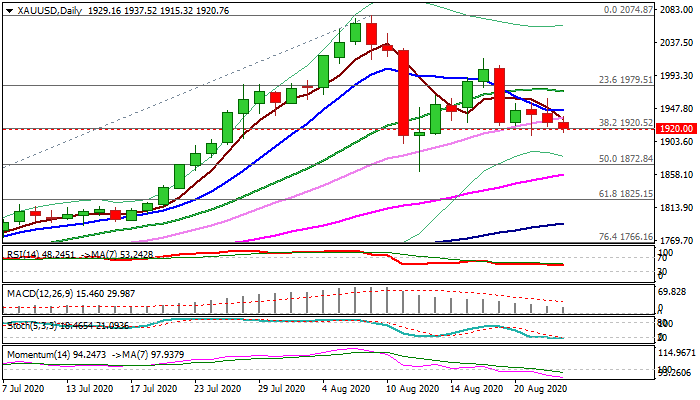

Spot gold holds in red for the third consecutive day and probes again below pivotal support at $1920 (Fibo 38.2% of $1670/$2074) bull-leg / former all-time high of 2011).

This level acts as solid support as it contained several attacks in past one week.

Gold keeps softer near-term tone on the optimism over global recovery and the latest news that US and China expressed their commitments to existing trade deal that faded demand for safe-havens and prompted traders into riskier assets.

Daily studies show strengthening negative momentum and overall weaker tone, suggesting further easing after initial pullback from new record high at $2074 was strongly rejected at $1862.

Eventual close below $1920 would further weaken near-term structure and risk drop towards pivotal $1862 support (12 Aug spike low), with break here to signal deeper correction.

On the other side, another failure to break $1920 support would signal prolonged consolidation, but the action is expected to remain biased lower while holding below 20DMA ($1971).

Res: 1937; 1946; 1961; 1971

Sup: 1911; 1900; 1872; 1862