Bulls remain in play for another attempt at 1.22 but vulnerable ahead of Brexit finale

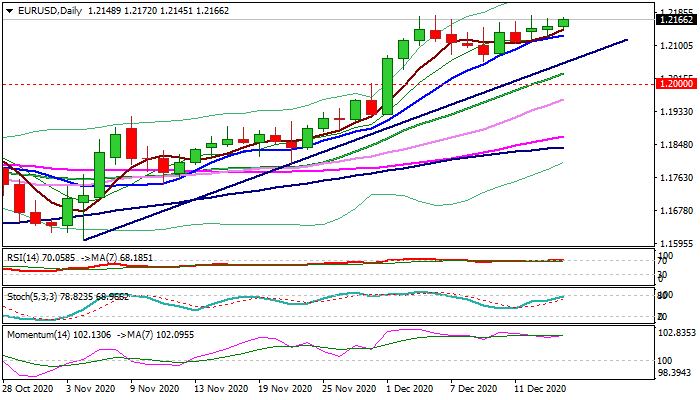

The Euro edges higher in early European trading on Wednesday and pressures new 2 ½ high (1.2177), following multiple failure at this level.

Larger bulls look for eventual break of 1.22 barrier to signal continuation of rally from March and expose key barriers at 1.2555/1.260 (2018 high / 200WMA).

Technical studies on daily and weekly chart maintain strong bullish momentum, but overbought conditions warn.

Rising 10DMA continues to track the advance and marks solid support at 1.2125, loss of which would weaken near-term structure and expose pivotal supports at 1.2064/58 (bull-trendline off 1.1602 Now low / Dec 9 correction low).

Fundamentals continue to play key role, with risk appetite on global optimism over vaccine success and anticipated recovery acceleration, continuing to support the single currency, but traders focus on Brexit finale.

The optimism that the deal could be reached by the weekend persists, however no-deal Brexit remains as possible scenario.

German and EU PMI’s are key events for euro today, with US retail sales also in focus.

Res: 1.2177; 1.2200; 1.2263; 1.2300

Sup: 1.2141; 1.2125; 1.2072; 1.2058