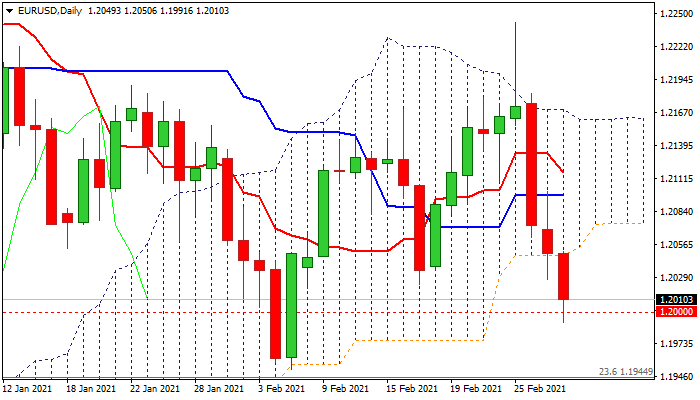

Bears crack psychological 1.20 support

The Euro tumbles on Tuesday as downbeat German retail sales data contributed to bearish near-term tone.

Bears remain firmly in play for the third straight day, despite Monday’s failure to close below the base of daily Ichimoku cloud and extended steep fall through important supports at 1.2020/1.2000 (100DMA / Fibo 76.4% of 1.1952/1.2249 / psychological).

Bearish daily studies add to weak near-term structure as the action, pressured by thick daily cloud, looks for fresh negative signal on close below 1.20 handle that would open way for test of next pivotal supports at 1.1952/44 (Feb 5 low / Fibo 23.6% of 1.0635/1.2349).

Clear break of these levels will complete bearish failure swing pattern on daily chart and signal deeper correction of 1.0635/1.2349 rally.

Broken daily cloud base (1.2053) reverted to strong resistance which needs to cap and keep bears intact.

Res: 1.2020; 1.2053; 1.2063; 1.2091

Sup: 1.1991; 1.1980; 1.1952; 1.1900