Aussie is consolidating after heavy losses, eyes US jobs data for fresh signals

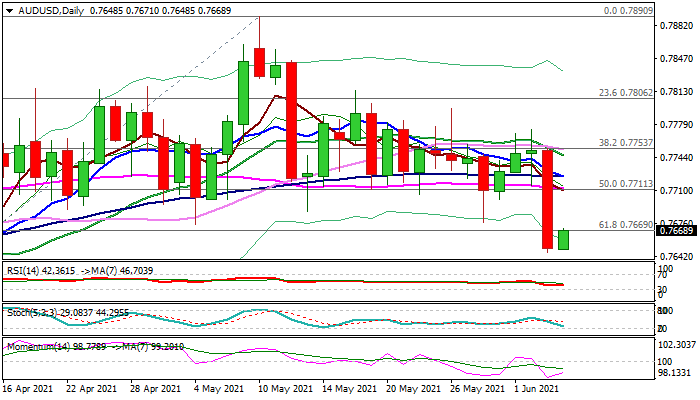

The Australian dollar is consolidating above new seven-week low at 0.7645, posted after 1.32% drop on Thursday, driven by upbeat US data that inflated the US currency.

Fresh bears (Thursday’s fall market the biggest one-day-loss since May 12) are taking a breather, as investors collect some profits from Thursday’s bearish acceleration, but large structure remains negative (momentum is in bearish territory on daily and weekly chart).

Thursday’s massive bearish daily candle weighs, with negative signal that was generated on daily close below pivotal Fibo support at 0.7669 (61.8% of 0.7531/0.7890), requiring confirmation on weekly close below this level.

Important Fibo barrier at 0.7694 (38.2% of 0.7773/0.7645 bear-leg) should ideally cap the upticks and keep near-term bias with bears, while extension through daily cloud base (0.7714) would sideline bears.

US jobs data are expected to provide more clues about Aussie’s near-term direction.

Res: 0.7677; 0.7694; 0.7714; 0.7735

Sup: 0.7645; 0.7634; 0.7616; 0.7585