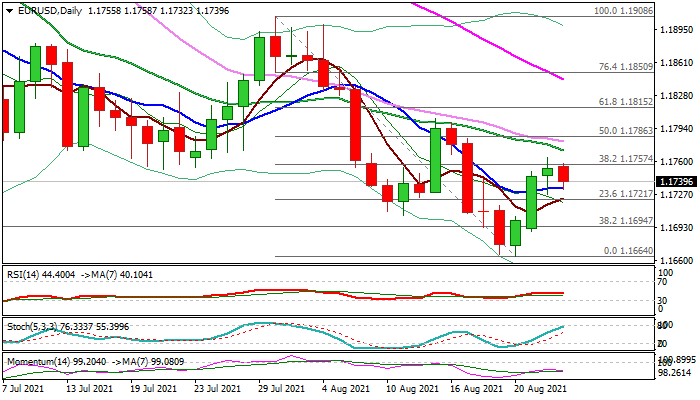

Near-term bias to remain negative while recovery is capped by pivotal Fibo barrier

The Euro standing at the back foot in early Wednesday’s trading after three-day recovery failed to break pivotal Fibo resistance at 1.1757 (38.2% of 1.1908/1.1664).

Near-term action is consolidating between Fibo barrier and 10 DMA (1.1733) which marks solid support, but return and close below would signal recovery stall and increase downside risk.

Fresh negative momentum and RSI turning south on daily maintain slight bearish bias, but traders await stronger direction signal.

Below 10DMA, pivotal supports lay at 1.1694 (Fibo 38.2% of 1.0635/1.2349 ascend) and 1.1664 (Aug 20 low), break of which would bring larger bears fully in play.

Conversely, sustained break of 1.1757 Fibo barrier and falling 20/30 DMA’s (1.1771/81) would sideline bears for stronger correction.

Res: 1.1757; 1.1771; 1.1781; 1.1804

Sup: 1.1733; 1.1694; 1.1664; 1.1600