Near-term focus shifts higher as dollar moves to the upper side of multi-week range

The dollar index is trading within a narrow range in early Monday but remains bid on prevailing risk-off mode and underpinned following last Friday’s 0.70% advance, which fully reversed post-Fed fall.

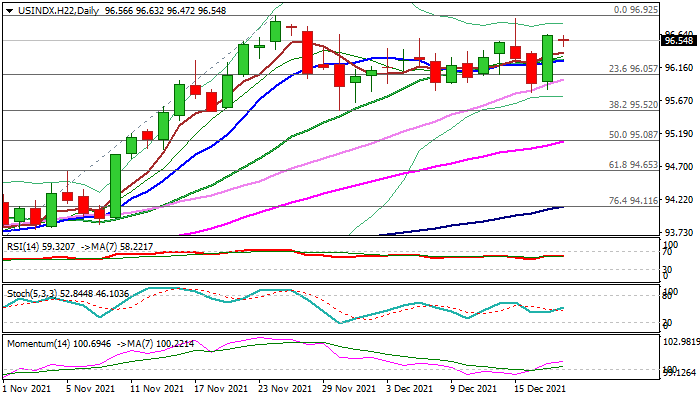

The price action moves into the upper part of the range that extends into fifth consecutive week, with near-term focus shifting to the upside, supported by rising bullish momentum on daily chart and price moving above daily Tenkan-sen (96.33).

Near-term bias is expected to remain with bulls while the price stays above this level, underpinned by bullish signal from eventual weekly close above 96.47 (50% retracement of larger 103.80/89.15 fall), although the action continues to face strong headwinds from new 2021 high (96.92, posted on Nov 24).

Fading bullish momentum and overbought RSI on weekly chart, add to worries of possible repeated stall on approach to 96.92 peak.

Bullish scenario requires a clear break of 96.92 to signal continuation of rally from 2021 low at 89.15 and expose targets at 97.78 (Jun 30 lower top) and 98.20 (Fibo 61.8% of 103.80/89.15) in extension.

Extended sideways mode could be expected while the price remains within 96.92/92.52 range, but near-term bias would turn negative on return below Tenkan-sen, while the downside would become more vulnerable on extension below 95.93 (daily Kijun-sen).

Res: 96.64; 96.87; 96.92; 97.45

Sup: 96.33; 96.05; 95.93; 95.79