Bulls look for a break through multi-year highs but may take some time for further consolidation

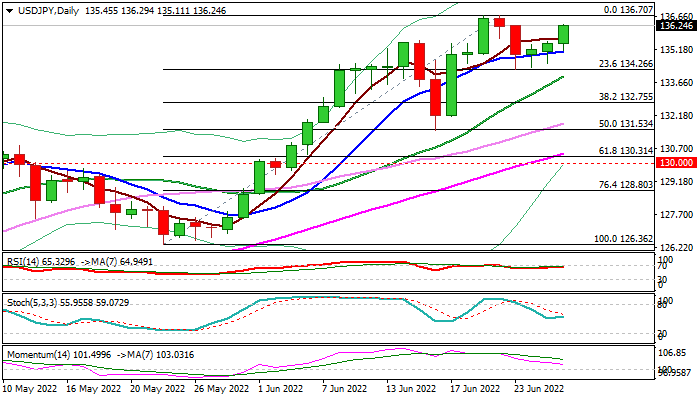

Shallow pullback from new multi-year high (136.70) found solid ground at 134.26 (Fibo 23.6% of 126.36/136.70) and subsequent bounce accelerated on Tuesday, retracing over 76.4% of 136.70/134.26 pullback, and confirming that bulls regained full control.

Overall picture remains firmly bullish as rally strongly accelerated in March and is on track for strong monthly gains in June.

The rally was boosted by strong safe-haven demand on migration from riskier assets into safety on growing uncertainty over the consequences of the conflict in Ukraine.

Bulls pressure strong barriers at 136.70/90 (2022 / 1998 peaks) with break here to unmask psychological 140 resistance.

Despite fresh bullish acceleration, daily chart shows weakening bullish momentum that warns of headwinds bulls may face and possibly hold in extended consolidation before final push higher.

Rising 10DMA (currently at 135.06) which keeps the downside protected since June 17, is expected to contain dips again and keep bulls intact.

Res: 136.70; 136.90; 137.28; 137.63

Sup: 135.67; 135.06; 134.26; 133.93