Solid UK jobs data additionally support recovery

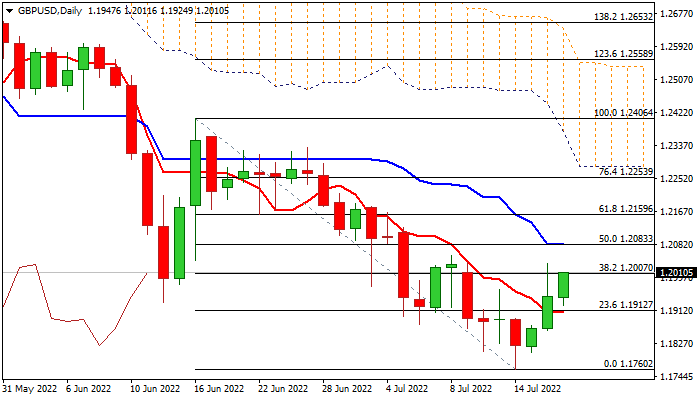

Cable keeps positive tone and attacks again pivotal 1.20 resistance zone (psychological / Fibo 38.2% of 1.2406/1.1760 bear-leg / trendline resistance), after Monday’s action spiked to 1.2033 but failed to sustain gains and closed below 1.20.

Sterling received fresh support from strong UK jobs data (unemployment remained unchanged at 3.8% vs 3.9% f/c and the number of people in employment rose by 296,000 in 3 months to May, strongly overshooting forecast for 170,000 increase) which signal that UK labor market is tightening that adds to confidence of the Bank of England about raising interest rates further next month.

Although positive fundamentals and weaker dollar continue to underpin recovery, technical studies on daily chart remain bearishly aligned and warn of limited correction before larger bears re-take control.

Fresh bulls face headwinds from 1.20 zone, which guards next pivotal barrier at 1.2083 (daily Kijun-sen / 50% retracement of 1.2406/1.1760).

Repeated failure to close above 1.20 barrier would generate initial signal of recovery stall, while extended upticks should be capped by 1.2083 resistance to keep larger bears in play.

Res: 1.2000; 1.2055; 1.2083; 1.2125

Sup: 1.1861; 1.1804; 1.1760; 1.1700