Dollar is consolidating under new two-decade high ahead of US jobs data

The dollar keeps firm tone and holding near new two-decade high in early Friday’s trading, after solid US manufacturing data on Thursday added to overall bullish stance.

The greenback remains well supported by risk aversion on growing uncertainty in global economy and expectations for further rate hikes, after Fed chair Powell confirmed the central bank’s strong commitment to restore the price stability and said that interest rates would need to be high for some time until the Fed reaches its target.

The most of market participants bet for another 0.75% rate hike later this months, after Powell made it clear that slowdown in economic growth, due to rising interest rates, would not derail the Fed from its fight against high inflation.

Markets await today’s release of August labor report, with expectations for 300K new jobs added last month, compared to 528K in July, still seen as solid figure which would add to Fed’s hawkish stance, while only significant fall below expectations would soften the tone and dent expectations for another aggressive action in the policy meeting in September.

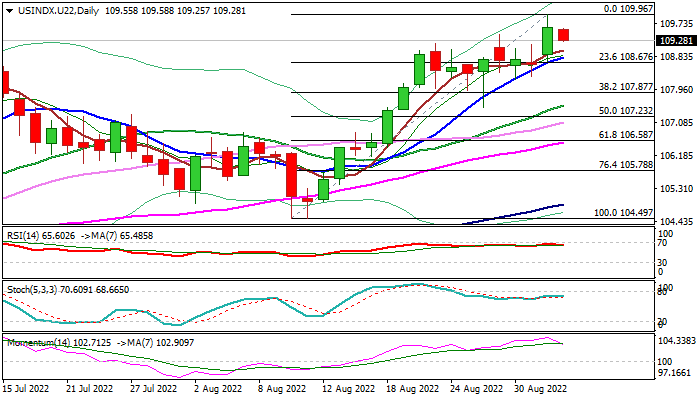

Fresh acceleration on Thursday hit new highest in twenty years, just ticks below psychological 110 barrier, break of which would signal bullish continuation and expose next target at 112.04 (June 2002 high), though bulls can accelerate further in supportive environment.

The dollar index entered September in bullish mode, following 2.6% monthly advance in August and is also on track for the third consecutive bullish weekly close.

Dips are so far expected to be shallow and offer better buying opportunities, with daily Tenkan-sen (108.71) to ideally contain and keep the downside protected.

Caution on scenario of disappointing US NFP numbers that would deflate bulls for deeper pullback.

Res: 110.00; 110.22; 110.90; 111.44

Sup: 109.12; 108.71; 108.21; 107.87