Sterling extends advance as risk sentiment improves further

Cable accelerated gains on Thursday, lifted by renewed risk sentiment, following comments from Fed Powell on Wednesday, which deflated dollar on less hawkish than expected stance, while solid US data on Thursday further boosted risk appetite.

Traders eye of US ISM manufacturing PMI (Nov f/c 49.8 vs Oct 50.2) which should contribute to positive tone on release above forecast, as well as Friday’s release of the US Nov labor report.

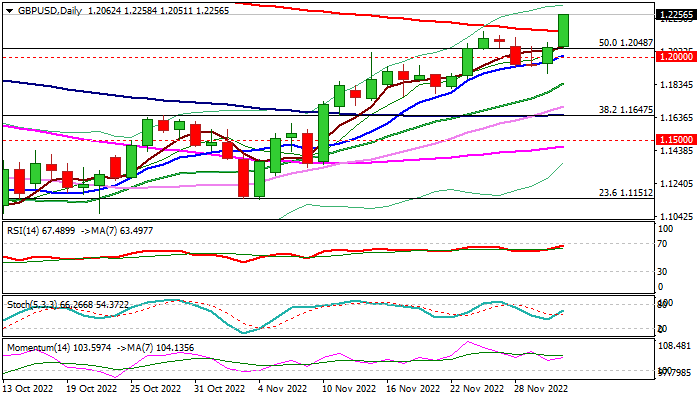

Fresh advance pushed the price to the highest level since Aug 8 and generated bullish signal on lift above falling 200DMA (1.2153), which also indicates continuation of larger uptrend from Sep 26 spike low at 1.0348.

Bulls pressure immediate barriers at 1.2293/76 (Aug 1,10 tops which formed a lower platform), break of which would unmask key Fibo barrier at 1.2449 (Fibo 61.8% of 1.3748/1.0348).

Today’s close above broken 200DMA to confirm strong bullish stance.

Res: 1.2273; 1.2296; 1.2332; 1.2400

Sup: 1.2153; 1.2100; 1.2048; 1.2000