Dollar is losing traction but more signals needed to spark deeper drop

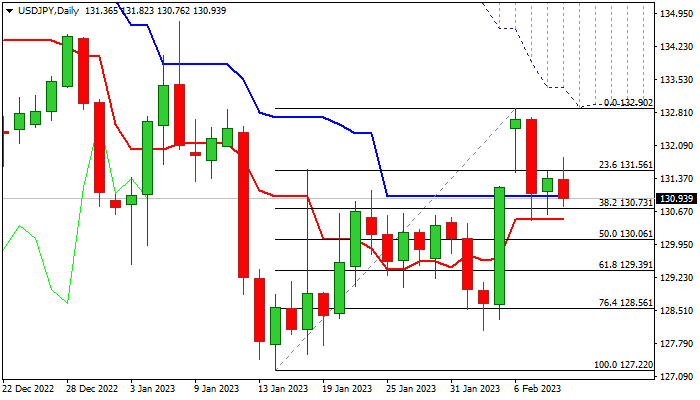

The USDJPY edged lower in early Thursday but remains within 130.50/132.90 range which extends into fourth consecutive day.

Fading bullish momentum and south-heading stochastic / RSI on daily chart, signal that the downside is vulnerable, but need a firm break of daily Kijun-sen (131.00) which contained dips in past two days, with extension below daily Tenkan-sen (130.49) to confirm reversal and open way for further retracement of 127.22/132.90 recovery phase.

Ability to hold above Kijun-sen support would keep an action in extended consolidation, but still weighed by falling thick daily cloud (base of the cloud lays at 132.92).

Investors are focusing on US inflation data for stronger direction signals, after the latest hawkish comments from Fed and speculations that US terminal rate would increase towards 6%, did not provide stronger support to dollar.

Res: 131.56; 131.82; 132.70; 132.92

Sup: 130.49; 130.00; 129.39; 128.56