USDJPY keeps firm tone ahead of US inflation data

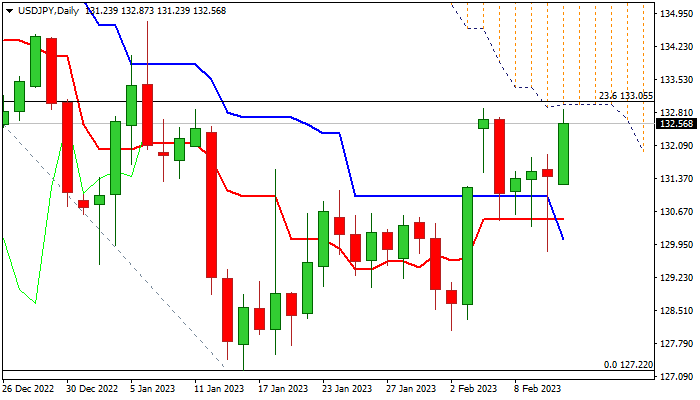

The USDJPY regained traction on Monday and rose to one-week high to pressure pivotal barriers at 133.00 zone, consisting of 55DMA / Fibo 23.6% of 151.94/127.22 / base of thick falling daily Ichimoku cloud.

Fresh strength is about to fully retrace last week’s shallow correction which was contained by rising 10DMA, with long tails of daily candlesticks of past three days signaling strong bids and well protected downside.

Bullishly aligned daily studies (rising bullish momentum / north-heading RSI / 10;20;30 DMA’s in bullish setup) underpin the action, though bulls are expected to face strong headwinds from thick daily cloud.

However, the most significant factor which will influence the pair’s near-term direction is Tuesday’s release of US inflation data.

US consumer prices are expected to ease to 6.2% in January from 6.5% one year ago, while monthly inflation is forecasted to rise by 0.5% in January from 0.1% previous month.

The core inflation, stripped from volatile components, is expected to ease to 6.2% y/y in January from 6.5% in December, although remains quite high (over 3 times the Fed’s 2% target) and may prompt the US central bank to keep hawkish stance on monetary policy and raise the level of terminal rate.

Higher than expected US CPI in January would add to growing signals that the Fed may hold in prolonged tightening cycle that would inflate dollar.

In addition, hawkish Fed and BOJ expected to keep its easy policy, would signal further divergence between the monetary policies of two central banks and keep the US currency supported.

In such scenario, the pair would receive fresh boost for break of 133.00 resistance zone , which will open way towards next key barriers at 136.66/83 (Fibo 38.2% / 200DMA).

Conversely, bigger than expected drop in US consumer prices would bring more optimism that inflation is firmly in downward trajectory and make the greenback less attractive for traders.

Loss of initial support at 130.95 (10DMA) would risk test of psychological 130 level, break of which would weaken near-term structure and shift near-term focus to the downside on completion of a double-top pattern.

Res: 133.05; 134.05; 134.77; 136.66

Sup: 131.88; 130.95; 130.26; 130.00