Bulls are taking a breather after strong rally

Bitcoin rallies for the third consecutive day as higher than expected US inflation and stronger dollar did not impact fresh and strong bullish sentiment, while strong rebound in US retail sales added to fading recession fears and contributed to renewed risk sentiment.

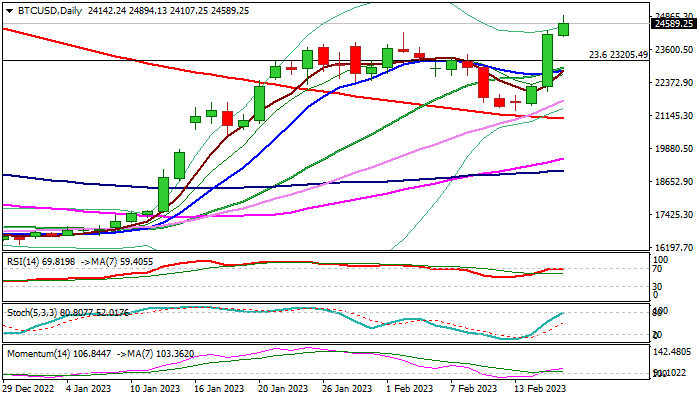

The price hit the highest in six months in early Thursday, in extension of Wednesday’s 8.7% advance (the biggest daily gains since Nov 10), following a break above previous top at 24243 (Feb 2).

Slight easing from new high was caused by a headwinds that bulls faced on approach to strong barrier at 24919 (200WMA), as well as overbought daily studies, which prompted traders to collect some profits from the recent strong bullish acceleration.

Wednesday’s massive daily bullish candle underpins the action, along with rising positive momentum, suggesting that fresh bulls are about to take a breather before resuming, with break of 200WMA to expose next key barrier at 27622 (base of falling thick weekly Ichimoku cloud).

Dips should be ideally contained by former top (24243), though deeper pullback towards rising daily Tenkan-sen (23115) cannot be ruled out and should provide better buying opportunities.

Res: 24919; 25194; 27462; 27622

Sup: 24243; 24054; 23433; 23115