Gold accelerates lower after US inflation data warned of more rate hikes

Gold accelerated lower on Wednesday (down around 1% in late Asia / early Europe) as traders moved back into dollar after US inflation was higher than expected in January.

Although inflation continues to ease, yesterday’s data showed that inflationary pressure persists that may push the US central bank for possible further policy tightening.

The US Federal Reserve repeated its readiness to continue raising interest rates for a longer period that previously anticipated, which would be negative for gold.

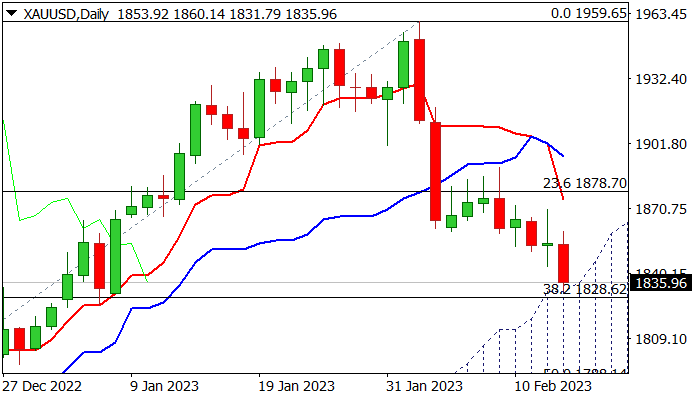

Fresh weakness extends the second leg from 2023 peak ($1959) and cracked strong supports at $1831/28 zone (top of rising daily cloud / Fibo 38.2% of $1616/$1959 rally), with break here to expose psychological $1800 support and Fibo 50% retracement ($1788), Daily studies show strong bearish momentum and multiple bear-crosses of 10;20;30DMA’s that maintains bearish pressure, although stronger headwinds from daily cloud and Fibo level ($1831/28) should be anticipated, with falling 10DMA ($1866) to cap upticks and offer better selling opportunities.

Res: 1849; 1866; 1878; 1895

Sup: 1828; 1800; 1788; 1776