Gold surges to one-year high

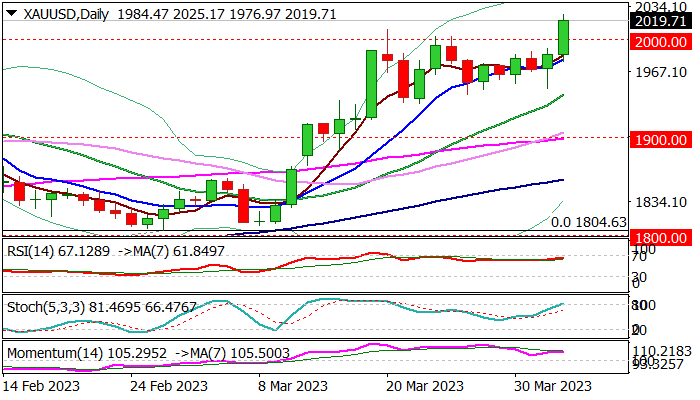

Gold was sharply up in early US trading on Tuesday, breaking through psychological $2000 level and hitting the highest since March 2022.

Fresh rally was sparked by weaker than expected US data which added to uncertainty and prompted traders from dollar into safety of the yellow metal

Today’s advance signals that extended consolidation under $2000 is likely over and the price is entering fresh bullish phase after a two-week pause.

Strong rise ($2025 peak reached so far and price holding there) adds to expectations that the latest break higher will be verified by close above broken $2000 level, which will generate bullish signal and unmask key targets at $2070 (Mar 2022 high) and $2074 (gold’s record high, posted on Aug 2020).

Overall environment is favorable for gold and improving, as the global economy remains fragile, weighed by persisting pressure from high energy prices, stubbornly high inflation, rising interest rates and continuous political and geopolitical tensions, which threaten to escalate.

Investors also sell dollar on growing speculations that the Fed may end its tightening cycle sooner than initially estimated, which also makes the greenback less attractive and adds support to gold.

Res: 2025; 2037; 2055; 2070

Sup: 2009; 2000; 1978; 1966