Gold price rises on concerns from weak US data

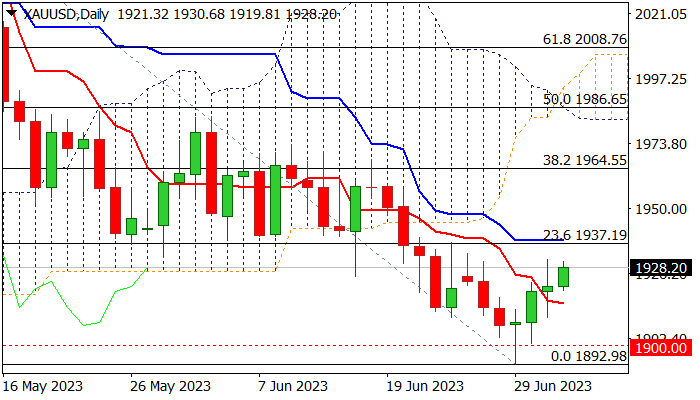

Gold price rises for the fourth consecutive day, extending recovery from a multi-week low at $1892 (June 29), after larger bears failed to clearly break psychological $1900 support and left a bear-trap.

Gold was inflated by growing expectations that the Fed may decide to pull the break and further pause its hiking cycle, as recent series of weaker than expected US economic data, warning that high interest rates may have impacted economic growth more than anticipated.

Traders wait for more cues from Fed minutes and US labor sector reports, due in coming sessions.

Technical picture improved on daily chart, but remains predominantly bearish, as 14-d momentum is still in negative territory, with sustained break of initial barriers at $1937/38 (Fibo 23.6% of $2080/$1892/ daily Kijun-sen) seen as minimum requirement to keep fresh bulls in play.

Today’s daily cloud twist could also attract bulls, though limited impact is likely on holiday-thinned markets.

Daily Tenkan-sen marks pivotal support at $1915, loss of which to revive bears for renewed attack at $1900 zone.

Res: 1931; 1938; 1945; 1964

Sup: 1919; 1915; 1909; 1900