Cable falls further, psychological 1.20 support coming in focus

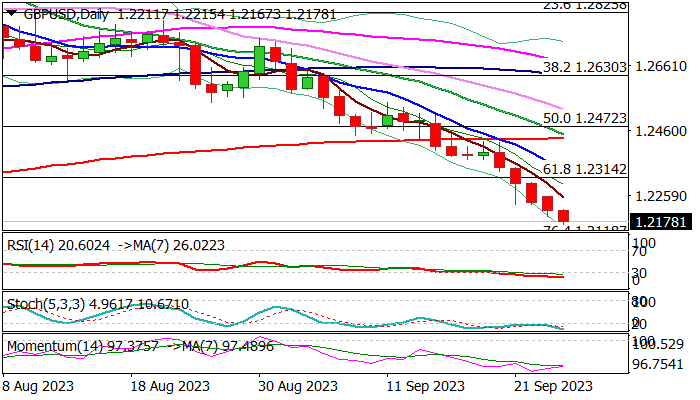

Cable dips below 1.22 mark on Tuesday, hitting the levels last traded in mid-March, in extension of the downtrend which steepened in past five days.

Soured risk sentiment and strong dollar on signals that the Fed may raise interest rates further and keep them high for longer period, continues to weigh on sterling.

Bears eye target at 1.2118 (Fibo 76.4% of 1.1802/1.3141uplrg) and 1.2074 (Fibo 38.2% of larger 1.0348/1.3141 uptrend) which guard psychological 1.20 support.

Firmly bearish daily studies contribute to negative outlook, though strongly overbought conditions suggest that bears may soon start to run out of steam and some price adjustment. Upticks should be limited and ideally capped by broken Fibo 61.8% (1.2314) and nearby falling daily Tenkan-sen (1.2336) to keep bears intact.

Res: 1.2215; 1.2252; 1.2314; 1.2336

Sup: 1.2118; 1.2074; 1.2000; 1.1944