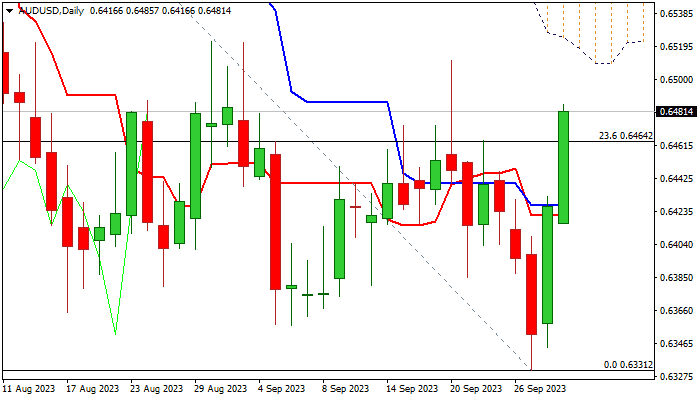

AUDUSD – recovery accelerates on month / quarter end profit taking

AUDUSD extends strong bounce from new 2023 low (0.6331) into second straight day, driven by profit-taking at the end of the month / quarter.

Slight change in Fed’s narrative on monetary policy from hawkish stance to unclear signals whether more policy tightening will be needed in coming months and looming partial US government shutdown, weighed on US dollar, putting larger bulls on hold and providing temporary relief to Australian currency.

Improving daily technical studies support recovery, with strong offers seen at 0.6510/20 zone (falling 55DMA / Aug 30 / Sep 1 double top / base of thick daily cloud), which should ideally cap recovery and offer better selling opportunities.

Conversely, penetration of daily cloud and sustained break above 0.6546 pivot (Fibo 38.2% of 0.6894/0.6331) would sideline larger bears for stronger recovery and expose targets at 0.6613/32 (50% retracement / daily cloud top).

Res: 0.6511; 0.6522; 0.6546; 0.6587

Sup: 0.6464; 0.6427; 0.6380; 0.6357