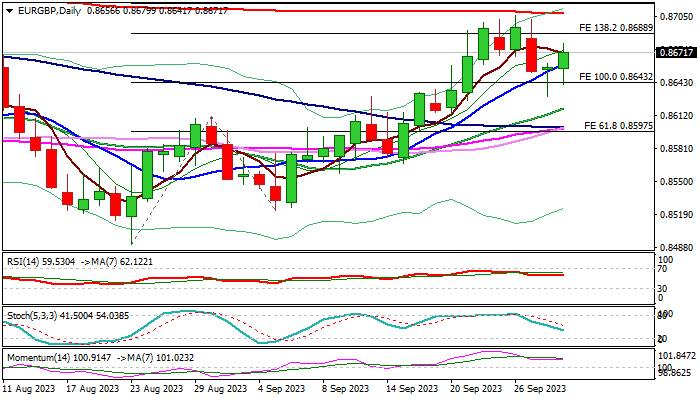

EURGBP regains ground after a shallow correction but 200DMA remains key obstacle

EURGBP regained ground on Friday and bounced from correction low (0.8630) completing the fourth (corrective) wave of five-wave cycle from 0.8492 (Aug 23 low).

The price is currently riding on the fifth wave, which should extend towards 0.8750 (also near Fibonacci 200% extension of rally from 0.8492), according to the wave principles.

Fresh strength aims again at key 200DMA (0.8707) which so far capped several attempts and firm break here is needed to signal continuation of larger uptrend.

Daily studies show strong positive momentum and Tenkan / Kijun-sen in increasingly bullish configuration, which adds to bullish signals along with a bear-trap, left after repeated false break below 0.8655 (Fibo 23.6% of 0.8492/0.8705 rally on Thu / today).

Near-term bias is expected to remain bullish while the price stays above 10DMA (0.8660), though repeated weekly close above 200WMA (0.8674) is needed to strengthen near-term structure.

Res: 0.8680; 0.8707; 0.8717; 0.8750

Sup: 0.8660; 0.8630; 0.8614; 0.8599