Gold – bulls tighten grip ahead of FOMC minutes / US inflation report

Gold price rose to the highest in almost two weeks on Wednesday, as bulls regained traction after pausing on Tuesday.

Gold rose on the latest crisis in the Middle East, as high uncertainty and threats of escalation prompted investors into safety, boosting strongly demand for the yellow metal.

In addition, latest dovish remarks from the Fed officials point to softer approach to interest rates in coming months, deflated the greenback and contributed to metal’s bullish near-term outlook.

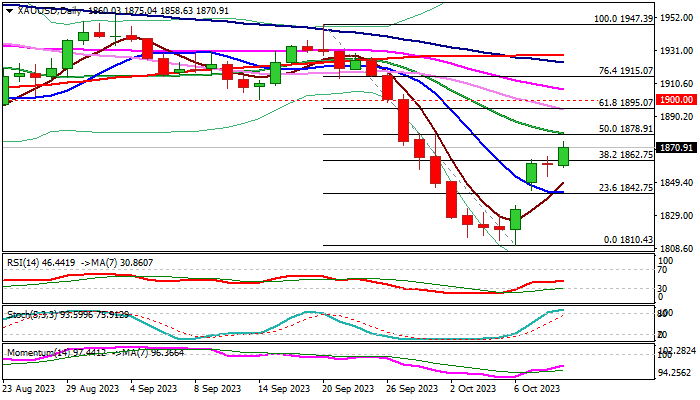

Situation on daily chart continues to improve as fresh gains broke above Fibo 38.2% of $1947/$1810 bear-leg at $1862 (though needs daily close above here to confirm the signal) and formation of 5/10DMA bull-cross.

On the other hand, 14-d momentum is heading north but still in negative zone and stochastic is strongly overbought, which may obstruct bulls, but near-term bias will stay with bulls while price action holds above $1860 zone (broken Fibo barrier / Wednesday’s low.

Bulls eye next pivots at $1880/84 (50% retracement / 20DMA / former base of mid-Aug) with firm break to further improve near-term picture and unmask key barriers at $1895/$1900 (Fibo 61.8% / psychological).

Caution on break below $1860 zone supports which would make the downside vulnerable of further losses.

The minutes of FOMC latest meeting and US Sep inflation report are the key events in these two days, with softer tones from the central bank and inflation in line or below expectations, to add pressure on dollar and further boost demand for gold.

Res: 1878; 1884; 1895; 1900

Sup: 1862; 1858; 1852l 1842