GBPUSD remains constructive despite weak UK data

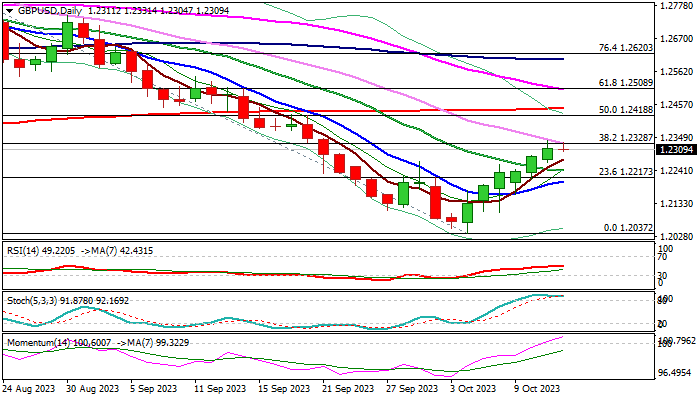

Cable is holding around 1.23 handle in early Thursday, after repeatedly cracking pivotal barrier at 1.2328 (Fibo 38.2% of 1.2800/1.2037 bear-leg, reinforced by falling 30DMA), but the action remains within a narrow range and with limited upside.

Sterling remains constructive despite weak UK economic data released earlier today, as Aug GDP was in line with expectations, but July’s figure was revised downward, while manufacturing sector performed below expectations and trade gap widened in August, adding to negative signals.

Anticipated fresh pressure on the US dollar after Fed minutes pointed to more careful approach to the monetary policy, in light of worsening global economic situation and growing uncertainty, would provide some support to pound.

Markets are awaiting release of US September CPI data (due later today) which would provide further relief to policymakers and weigh on greenback if inflation falls in line or below expectations.

Technical picture on daily chart is improving as rising 14-d momentum broke into positive territory and 10/20DMA’s turned to bullish configuration, though overbought stochastic and RSI moving sideways in neutrality zone (50) warn that bulls may face stronger headwinds.

Bullish scenario sees clear break of 1.2328 pivot as a minimum requirement to signal continuation of six-day recovery rally and expose targets at 1.2418/43 (50% retracement of 1.2800/1.2037 / 200DMA respectively).

Conversely, repeated failure at 1.2328 would increase risk of recovery stall, with extension below daily Tenkan-sen (1.2187) to signal reversal and shift near-term focus to the downside.

Res: 1.2328; 1.2386; 1.2418; 1.2443

Sup: 1.2276; 1.2240; 1.2207; 1.2187