GBPUSD – risk aversion continues to pressure

GBPUSD fell to the lowest in three weeks in early Thursday, pressured by renewed risk aversion on growing concerns that interest rates would stay high for longer period.

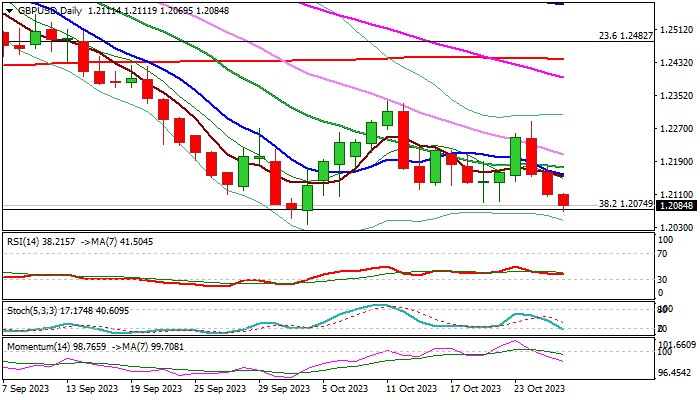

Bear-leg off 1.2288 (Oct 24 lower top) extends into third straight day, with break of pivotal Fibo support at 1.2108 (76.4% retracement of 1.2037/1.2337 recovery), 1.2090 (Oct 19 trough) and 1.2074 (Fibo 38.2% of larger 1.0348/1.3141 uptrend expected to generate fresh bearish signal for attack at 1.2037/29 (Oct 4 low / weekly Ichimoku cloud top) and psychological 1.20 support in extension.

Daily studies maintain strong negative momentum and MA’s are in full bearish setup, contributing to negative near-term outlook, though bears may face headwinds as stochastic is entering oversold territory, (signal is already developing on hourly and 4-h charts).

Upticks should be capped at 1.2150/70 zone to keep bears intact and offer better selling opportunities.

Caution on extension and close above 1.2200 zone which would sideline immediate bears.

Res: 1.2111; 1.2158; 1.2176; 1.2208

Sup: 1.2052; 1.2037; 1.2000; 1.1915