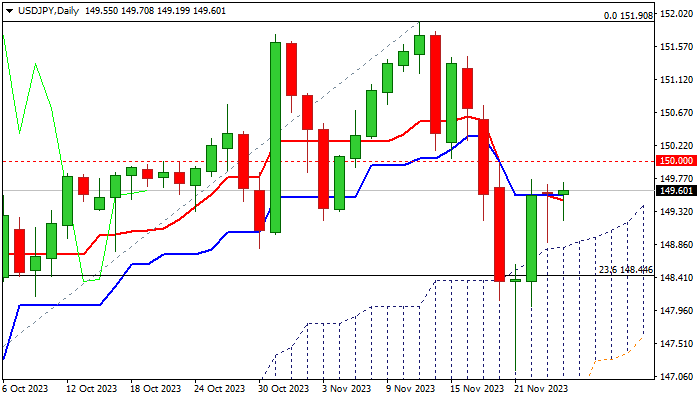

USDJPY – recovery turns sideways between daily cloud top and psychological 150 barrier

USDJPY is holding within a narrow consolidation for the second consecutive, with quiet mode seen as a result of lower volumes on closure of US markets for Thanksgiving Day holiday.

Recent recovery from 147.15 (Nov 21 low of correction from 151.90 peak) seems to be losing traction, despite formation of reversal pattern on daily chart and the action still being underpinned by thick ascending daily Ichimoku cloud.

Weakening studies on daily chart as14-d momentum returned to negative territory, with 10/20 and 10/30DMA bear-cross adding to initial warning of recovery stall under 150 barrier.

However, fresh signals require confirmation on penetration into daily cloud (cloud top lays at 148.90) and violation of Fibo support at 148.44 (23.6% retracement of 137.23/151.90 rally), to open way for attack at 147.15 (Nov 21 spike low) and expose pivotal supports at 146.73/30 (100DMA / Fibo 38.2%).

Fundamentals also contribute to such scenario, as narrowing rate gap between the Fed and BOJ and quick change in Fed’s rate outlook from further hikes towards rate cuts, may prompt traders to exit dollar longs and increase pressure on greenback.

Res: 150.00; 150.23; 151.00; 151.43

Sup: 148.90; 148.44; 148.01; 147.15