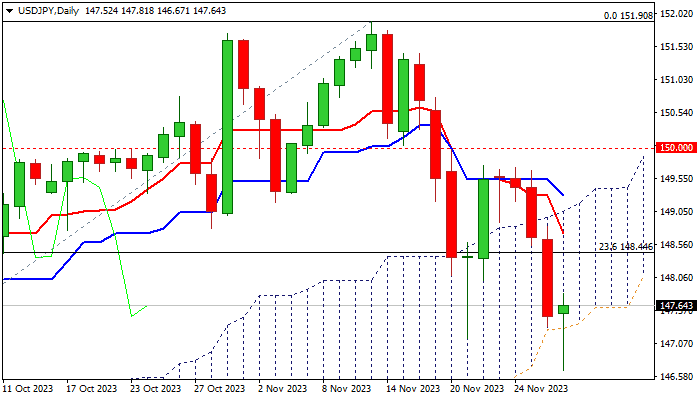

USDJPY – bears are consolidating for fresh push through daily cloud base

USDJPY bounces from new ten-week low on Wednesday, as bears faced headwinds on probe through the base of daily cloud (147.38) and from 100DMA (146.97).

Fresh jump was sparked by dovish comments from BoJ policymaker, who said that it is still early to talk about exiting from negative rate policy.

However, bounce is likely to be limited and short-lived as dollar remains under pressure from talks of an end of Fed tightening cycle and beginning to cut interest rates, probably in the second quarter of 2024 (growing bets for the first rate cut in May).

Broken Fibo 23.6% of 137.23/151.90 (148.44) should ideally cap upticks and keep near-term bias with bears.

Close below cloud base to reinforce negative near-term stance for extension towards 146.30 (Fibo 38.2) and possible further acceleration on break.

Only lift and close above daily cloud top (149.05) would defer.

Res: 147.81; 148.44; 148.93; 149.05

Sup: 147.38; 146.67; 146.30; 145.90