Dollar index – limited correction likely to precede fresh weakness

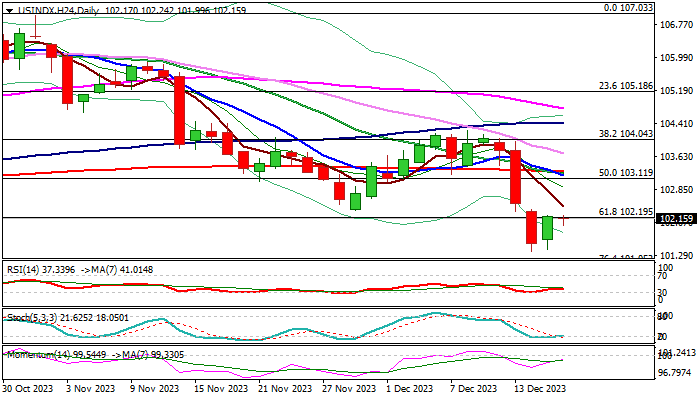

The dollar index is struggling to extend recovery from last week’s 1.7% drop, with the action being repeatedly capped by broken Fibo support at 102.19 (61.8% of 99.20/107.03) which reverted to solid resistance.

Dollar’s sentiment weakened further on fresh signals from Fed that tightening cycle is likely over and growing speculations about rate cuts in 2024.

Technical picture remains firmly bearish on daily chart (MA’s in full bearish configuration formed a triple death-cross / negative momentum and adds to negative near-term outlook.

Limited profit-taking is likely to result in a mild correction which will provide better levels to re-enter bearish market.

Weekly close below cracked Fibo pivot at 102.19 is needed to generate fresh bearish signal and open way for attack at 101.05 (Fibo 76.4%), possibly to psychological 100 support on stronger acceleration.

Upticks should be capped under 102.50 zone (Fibo 38.2% of 104.24/101.37) to keep bears intact and guard upper pivot at 102.81 (daily Tenkan-sen / 50% retracement).

Res: 102.36; 102.50; 102.81; 103.14

Sup: 102.00; 101.83; 101.37; 101.05