EURUSD – post-French election rally was so far capped by thickening daily cloud

EURUSD – post-French election rally was so far capped by thickening daily cloud

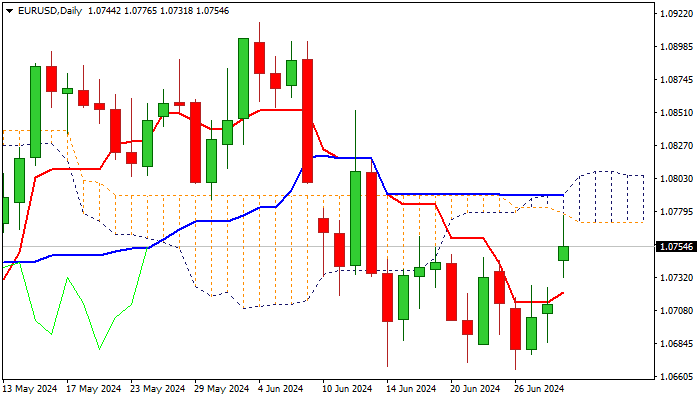

EURUSD opened with gap-higher and rose to three-week high in early European trading on Monday, lifted by results of the first round French parliamentary election.

Rally was capped by the base of thickening daily cloud, following last week’s cloud twist, with subsequent easing, pointing to strength of 1.0778/1.0800 resistance zone (daily cloud, spanned between 1.0777 and 1.0791 and reinforced by converged 100/200DMA’s / psychological resistance).

Daily studies show strengthening positive momentum, MA’s in mixed setup, while daily cloud remains strong obstacle.

Near term price action may hold in prolonged consolidation while capped by cloud, but with slight bullish bias as long as today’s gap stays unfilled.

Sustained break higher would bring near term bulls fully in play and open way for further retracement of 1.0915/1.0666 bear-leg.

Conversely drop and close below daily Tenkan-sen (1.0712) would weaken near term structure and risk retest of 1.0666 higher base.

Res: 1.0777; 1.0800; 1.0820; 1.0852

Sup: 1.0731; 1.0712; 1.0700; 1.0666