The dollar index remains within near-term range ahead of key US inflation data

The dollar index edged higher in Friday morning but is still holding within a choppy range that extends into sixth straight day.

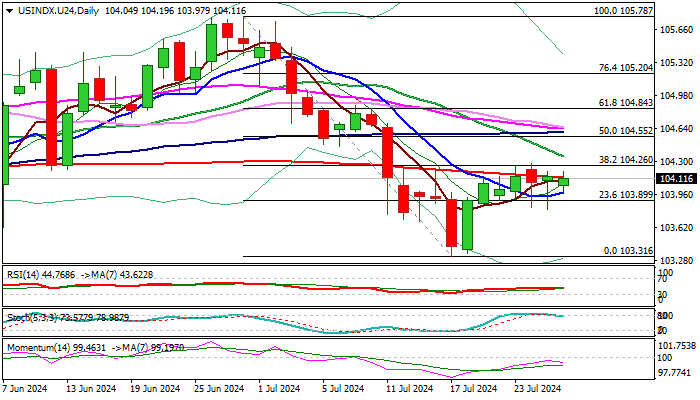

Long tails of daily candle of past two days and repeated closes above north turning 10DMA, add to existing bullish near-term bias.

Fresh strength is probing again through 200DMA (104.13), which capped the recent action and pressuring next pivotal barrier at 104.26 (Fibo 38.2% of 105.78/103.31) with sustained break here needed to generate fresh bullish signal and open way for further recovery.

However, risk of repeated stall here exists, as 14-d momentum is still in the negative territory and stochastic is reversing from overbought zone.

Look for firmer direction signals of break of either pivotal levels – 103.97 (10DMA) on the downside, or 104.26 (Fibo 38.2%) at the upside.

Fundamentals are likely to play a key role in driving the dollar today, after upbeat US Q2 GDP provided support on Thursday, with markets focusing on release of US PCE data (Fed’s preferred inflation gauge), to get more details about the timing of Fed’s rate cuts.

Markets expect the central bank to stay on hold in next week’s policy meeting, but to deliver three rate cuts by the end of the year, with wide expectations for the action to start in September.

Res: 104.26; 104.34; 104.55; 104.67

Sup: 103.97; 103.80; 103.67; 103.31