Dollar rises further on less aggressive Fed rate cut outlook

The dollar remains in strong bullish acceleration for the third consecutive day, boosted by expectations that Trump’s victory in the US presidential election would boost the economy and ease pressure on Fed, while fading expectations for aggressive rate cuts in coming months, added support the US currency.

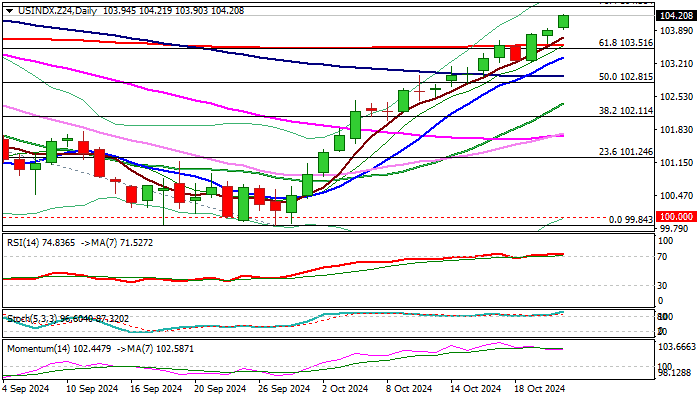

The dollar index, which tracks performance of US dollar against the basket of major currencies, broke above 104.00 barrier and rose to eleven-week high on Wednesday.

Bulls eye targets at 104.38/54 (Fibo 76.4% of 105.78/99.84 / July 30 lower top, violation of which to open way towards 105.78 (June 28 peak).

Meanwhile, negative signals are developing on daily chart (bullish momentum is fading and RSI is overbought) and suggest that bulls may start losing traction in coming sessions and pause for consolidation.

Bullish structure of daily studies (multiple MA bull-crosses / strong positive momentum) suggest that larger bulls hold grip, and corrective action should be limited.

Broken 200DMA / Fibo 61.8% (103.57/51) should provide firm ground and prevent deeper pullback towards 103.00/102.80 zone.

Res: 104.38; 104.54; 105.00; 105.47

Sup: 103.90; 103.57; 103.33; 103.00