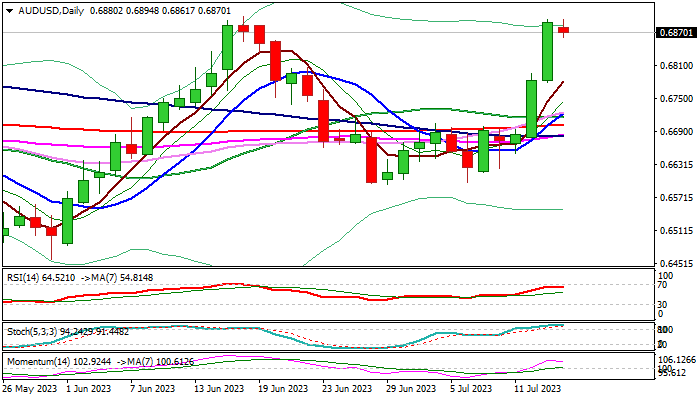

AUDUSD – bulls are taking a breather under key resistance zone

Bulls are pausing just under key resistance zone at 0.6890/0.6900/15 (Fibo 61.8% of 0.7157/0.6458 / June 16 peak / weekly cloud top) which was cracked after sharp bullish acceleration in past two days (the pair was up 3.1%).

Markets reacted mildly on RBA’s decision to replace Governor Lowe by Michelle Bullock, the first female to lead the central bank, letting near-term action to be driven by technicals.

Some profit taking at the end of the week after strong rally, would be likely scenario as daily studies are overbought and produced increased headwinds on approach to key barriers.

Pullback is likely to be limited, as positive sentiment is strong and daily indicators (MA’s / momentum) remain in firm bullish setup and setting scope for fresh push higher after correction.

Initial support lays at 0.6824 (Fibo 23.6% of 0.6595/0.6894 upleg) with deeper dips to be contained above 0.6800 zone, to keep bulls in play.

Firm break of pivotal 0.6900 resistance zone would generate fresh bullish signal and further strengthen near-term structure for extension towards targets at 0.6955 (100WMA); 0.7000 (psychological) and 0.7044 (200WMA).

Res: 0.6900; 0.6915; 0.6955; 0.7000

Sup: 0.6824; 0.6800; 0.6780; 0.6745