Aussie breaks below thick daily cloud on increased pressure after solid US data

The AUDUSD pair extends steep fall into sixth straight day and accelerated to new over two-week low after better than expected US data.

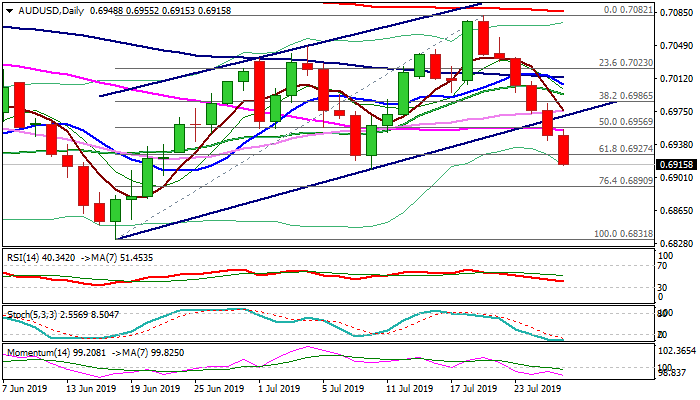

Bears broke below important Fibo support at 0.6927 (61.8% of 0.6831/0.7082 ascend) and probed below the base of thick daily cloud (0.6923) after US GDP data showed better than expected results in Q2 (GDP 2.1% vs 1.8% f/c and 3.1% in Q1 / Consumer Spending 4.3% vs upward-revised 1.1% in Q1) which was enough to further inflate US dollar.

Weak sentiment helps bears which generated negative signal on Thursday’s close below bull-channel support line and pressure key support at 0.6910 (10 July trough), with Friday’s close below daily cloud base to add to negative tone.

Rising bearish momentum, negative setup of MA’s on daily chart and signals of very strong bearish weekly close, support the action.

Caution on deeply oversold but still south-heading stochastic, which may slow bears in coming sessions and even spark some corrective action, with bears to remain in play while broken channel support line caps upticks.

Res: 0.6927; 0.6954; 0.6970; 0.6986

Sup: 0.6910; 0.6877; 0.6855; 0.6831