Aussie extends strong recovery rally on optimism of US/China deal and generates signals of major reversal

The Australian dollar hit five-week high against US dollar at 0.7250 in early Friday’s trading, in extension of Thursday’s 1.8% rally (the biggest one-day gains since 18 July 2017).

Strong signals of easing trade tensions between US and China, on news that President Trump had asked US officials to draft a possible trade deal with China, provided relief and strongly boosted Australian dollar.

Renewed optimism about Brexit deal and weaker than expected US ISM Manufacturing PMI, added to negative factors that pressure the US dollar.

On the other side, little negative impact on Aussie was seen from weaker than expected Australian retail sales, released earlier today.

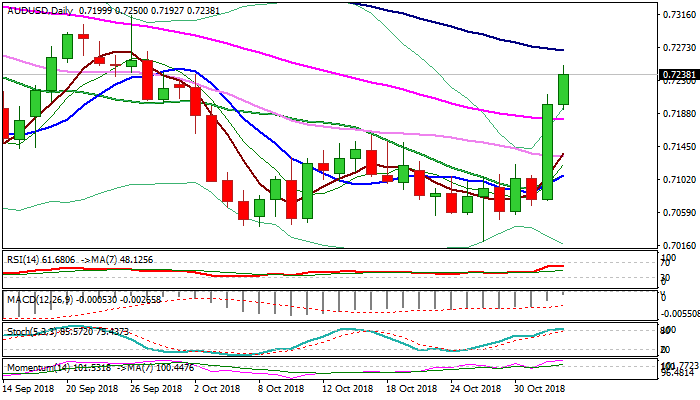

Extension of Thursday’s rally penetrated falling daily cloud (cloud base lays at 0.7226) and cracked 0.7245 barrier (Fibo 76.4% of 0.7314/0.7020), generating strong signals of major reversal.

The pair is on track for strong bullish weekly close, which supports scenario.

Bulls need to clear barriers at 0.7270 (falling 100SMA / 20WMA / daily cloud top); 0.7300 (trendline resistance) and 0.7314 (26 Sep spike high) to confirm reversal.

Firmly bullish daily and improving weekly techs support the notion, with positive sentiment to be boosted further if US jobs data fall below expectations.

Res: 0.7250; 0.7270; 0.7300; 0.7314

Sup: 0.7192; 0.7179; 0.7159; 0.7132