Aussie extends weakness after unchanged RBA

The Aussie dollar fell below 0.72 handle after Australian central bank left interest rates unchanged at 1.5% in October meeting.

The action was widely expected, increasing expectations that rates will remain low for an extended period as inflation is not expected to rise much and labor market will need time to tighten.

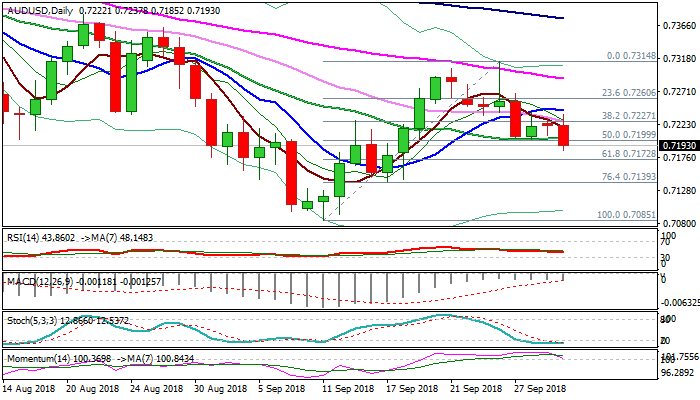

Fresh weakness broke below key supports at 0.7200 zone (20SMA / low of two-day consolidation / 50% of 0.7085/0.7314 upleg), signaling extension of pullback from 0.7314 (26 Sep correction high).

Firm break below 0.72 handle would risk further weakness and test of pivotal support at 0.7172 (Fibo 61.8% of 0.7085/0.7314 upleg), break of which would confirm reversal and re-focus key support at 0.7085 (11 Sep low).

Momentum is in steep descend and about to break into negative territory, supporting negative scenario, however, oversold slow stochastic may slow bears.

Broken 30SMA (0.7227) is expected to cap and maintain bearish pressure.

Res: 0.7203; 0.7227; 0.7243; 0.7268

Sup: 0.7185; 0.7172; 0.7139; 0.7100