Aussie maintains bearish sentiment after limited impact from better than expected data

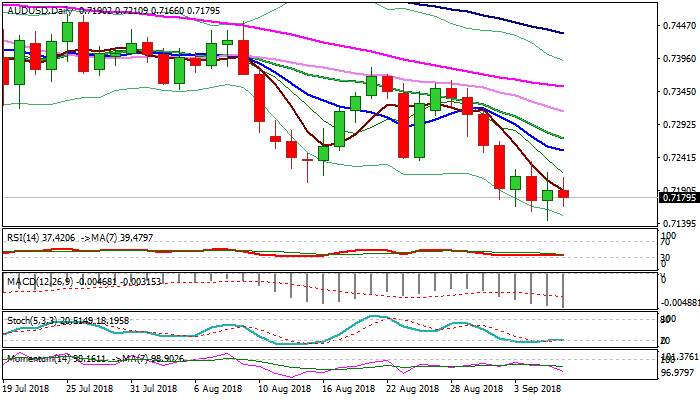

The Australian dollar slipped from session high at 0.7210 in late Asian trading, following short-lived advance after better than expected Australian trade data (trade surplus A$1.55 bn vs 1.46 bn f/c).

Prevailing bearish sentiment on turmoil in emerging markets was boosted by ANZ hike of mortgage rates, keeping bearish bias.

Daily techs maintain strong bearish momentum for renewed probe through cracked key supports at 0.7160 zone (May/Dec 2016 higher base), clear break of which would signal continuation of larger downtrend from 2018 high (0.8135) towards psychological 0.7000 support.

Falling 10SMA (0.7252) is expected to keep the upside protected.

Res: 0.7210; 0.7235; 0.7252; 0.7272

Sup: 0.7160; 0.7143; 0.7100; 0.7000