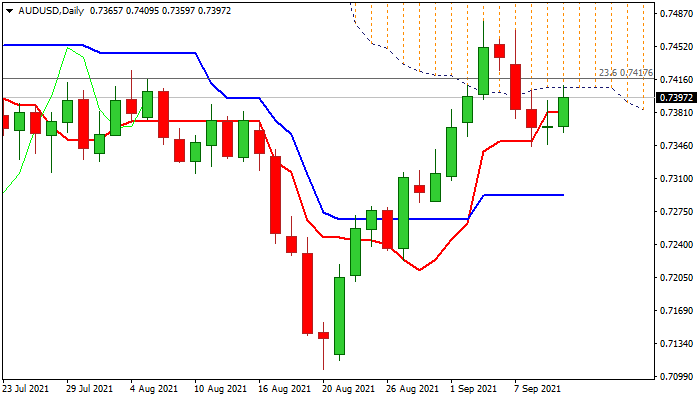

Aussie regains traction but fresh bulls face strong headwinds from falling thick daily cloud

The Australian dollar regained traction on Friday and bounced to three-day high, confirming initial reversal signal., after Thursday’s Doji candle signaled that three-day pullback from new highest in nearly two months (0.7478) lost traction.

Fresh advance was underpinned by growing optimism on Biden-Xi call as two presidents discussed avoiding conflict that lifted risk-sensitive Aussie.

Bulls face strong barriers at 0.7408/11 (daily cloud base / 50% retracement of 0.7478/0.7345 bear-leg) and break here would signal an end of corrective phase and reversal, with weaker US dollar on pre-weekend profit-taking

However, risk of recovery stall is still in play, keeping the downside vulnerable.

Daily studies are mixed as falling thickening daily cloud weighs and bullish momentum is fading, partially offsetting positive signals from DMA’s (10;20;30;55) in bullish configuration and forming multiple bull-crosses.

Expect initial direction signals on break of either 0.7345 (Sep 8 low) or 0.7408 (daily cloud base).

Res: 0.7408; 0.7426; 0.7478; 0.7498

Sup: 0.7378; 0.7345; 0.7327; 0.7308