Aussie dollar stays afloat after RBA paused but kept hawkish stance

Australian dollar regained traction after post-RBA dip and holding above thin daily cloud, pressuring strong barriers at 0.0.6690 zone (Monday’s high / converged 100/200DMA’s).

The Australian central bank surprised markets by holding interest rates unchanged at 4.10%, the highest in 11 years, as wide expectations were for another 25 basis points hike.

The RBA opted to pause after raising rates by 400 basis points since May last year, to asses the impact of the past hikes, although kept hawkish tone and signaled that further tightening might be needed to bring elevated and sticky inflation, which was running at 7% in Q1, under control and push it towards central bank’s 2-3% target by mid-2025.

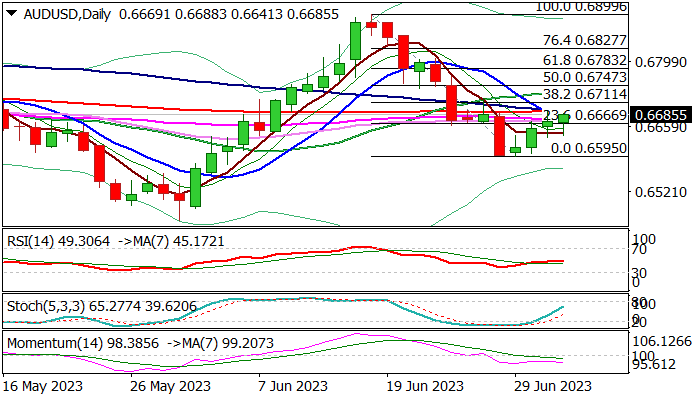

Technical picture on daily chart remains bearishly aligned as 14-d momentum is negative and most of moving averages still in bearish setup, keeping the downside at risk as long as price action stays below key barriers at 0.6690/0.6711 zone (100/200DMA’s / Fibo 38.2% of 0.6899/0.6595 fall.

Bearish scenario on repeated rejection at 0.6690 zone sees risk of surge through thin daily cloud and retest of pivotal support at 0.6595 (higher base of June 28/29).

Conversely, sustained break of 0.6690/0.6711 triggers would open way for acceleration of recovery leg from 0.6595.

Res: 0.6690; 0.6711; 0.6747; 0.6783

Sup: 0.6641; 0.6618; 0.6595; 0.6562