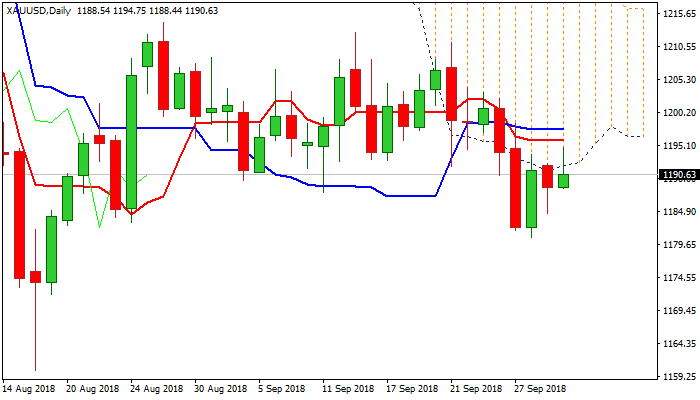

Base of thick daily cloud continues to limit recovery attempts

Spot Gold ticked higher on Tuesday as risk appetite on new trade agreement between the US and Canada started to fade and lifted yellow metal’s price.

Gains were so far limited as bulls face strong headwinds from thick daily cloud which continues to weigh heavily on near-term action.

Cloud base (currently at $1191) repeatedly capped upside attempts in past three days and limits today’s recovery attempts for now.

In addition, a cluster of converged daily MA’s (10/20/30) in $1195/98 zone reinforces resistance and guards psychological $1200 barrier, which marks upper pivot.

Negatively aligned daily techs (MA’s in bearish setup and growing bearish momentum warn that recovery attempts may run out of steak at daily cloud base and shift near-term focus lower.

Key near-term support lays at $1181 (Fibo 61.8% of $1160/$1214 / 28 Sep low), loss of which would open way towards key short-term support at $1160 (16 Aug spike low, the lowest since early Jan 2016).

Bullish scenario requires close above $1200 pivot to revive bulls and expose barriers at $1211/14 (21 Sep / 28 Aug highs).

Res: 1191; 1195; 1198; 1200

Sup: 1188; 1184; 1181; 1172