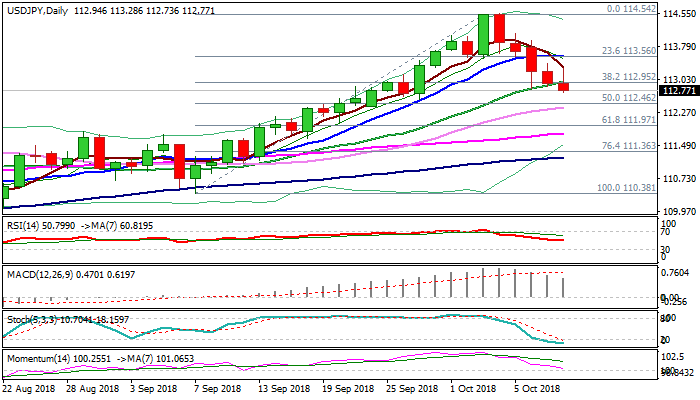

Bearish signal on eventual break below 112.95 Fibo support

The dollar accelerated lower to new two-week low at 112.73 against yen as US stocks fell in early trading on Thursday.

Fresh weakness emerged from session high at 113.28, where recovery attempts stalled and generating negative signal on eventual break below cracked Fibo support at 112.95 (38.2% of 110.38/114.54 rally, reinforced by 20SMA), which requires confirmation on daily close below.

Weakening momentum is approaching the border of negative territory and maintains pressure, while slow stochastic is continuing to head south, deeply in oversold zone.

Bears eye next pivotal support at 112.46 (50% of 110.28/114.54 / daily Kijun-sen) to signal deeper correction on break.

US CPI data on Thursday are in focus for fresh signals.

Res: 112.95; 113.28; 113.56; 113.94

Sup: 112.73; 112.46; 112.37; 111.97