Bearish techs favor further downside but politics expected to be pound’s key driver

Cable holds within narrow range in early Wednesday’s trading, after recovery attempts on Tuesday were strongly rejected, but downside was limited by daily cloud base.

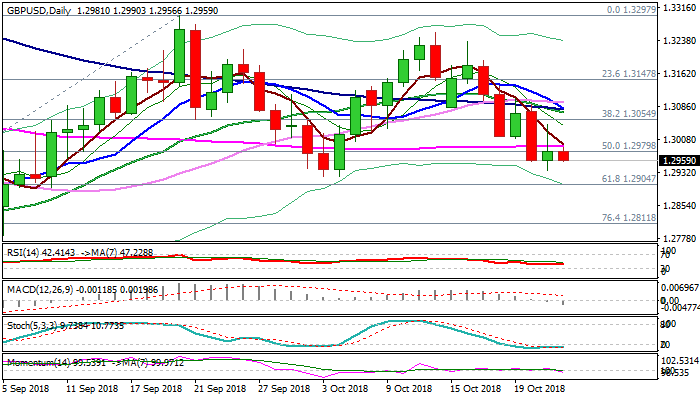

Technical studies on daily chart are gaining fresh negative momentum and MA’s are in bearish setup, as 55SMA continues to cap after being broken on Monday.

On the other side, oversold slow stochastic warns of consolidative / corrective action, but so far without firmer signal.

Politics are once again seen as pound’s key driver, with Brexit story getting more complicated by conflict within PM May’s Conservative party as many oppose her Brexit plan and May will address party’s lawmakers today, in attempt to calm growing tensions.

The meeting could be crucial for May’s leadership and traders closely watch the situation, as slight optimism on news on Tuesday that the EU is preparing new plan to offer solution for the Irish border problem, is fading.

Bearish signals could be expected on firm break below key supports at 1.2921 (03/04 Oct lows) and 1.2904 (Fibo 61.8% of 1.2661/1.3297), which would signal bearish continuation towards 1.28 zone (Fibo 76.4% at 1.2811 and 05 Sep trough at 1.2785).

Initial bullish signal could be expected on break and close above 55SMA (1.2994) and psychological 1.30 barrier, which would sideline immediate bearish threats and signal recovery.

Converged daily MA’s at 1.3071/95 zone mark pivotal barriers, break of which is needed to neutralize downside risk and shift focus to the upside.

Res: 1.2994; 1.3012; 1.3043; 1.3071

Sup: 1.2936; 1.2921; 1.2904; 1.2811