Bears could extend towards key supports at 5.00/4.82; Turkey CPI data eyed for fresh signals

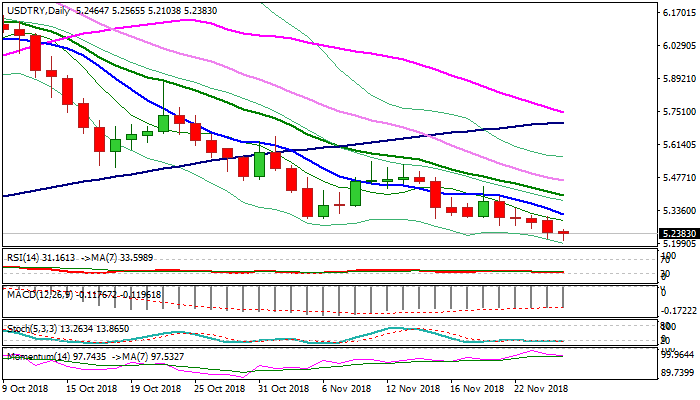

The USDTRY hit new nearly four-month low at 5.21 on Tuesday in extension of wave C (which commenced from 6.8379, 30 Aug lower top), of five-wave cycle from all-time high at 7.1074 (13 Aug).

Extended third wave, eyes 200SMA (5.1174) break of which would open FE123.6% at 5.0316 and risk attack at strong support zone between 5.00 and 4.82 (psychological 5.00 support; FE138.2% and Fibo 38.2% of 2008/2018 ascend).

The CBRT’s ultra-tight policy works in favor of lira’s bulls for now, along with significantly improved sentiment after Turkey released detained US pastor.

Focus turns towards release of Turkey’s CPI data next Monday, as strengthening lira and strong fall in oil prices, could push the inflation higher.

Pullback from new record high is still seen as correction rather than direction change, with sustained break below 4.82 required to generate stronger reversal signal.

Therefore, lira’s recent bulls are expected to face strong headwinds from key 5.00/4.82 support zone.

Res: 5.2565; 5.3197; 5.3430; 5.3950

Sup: 5.2100; 5.1808; 5.1174; 5.0316