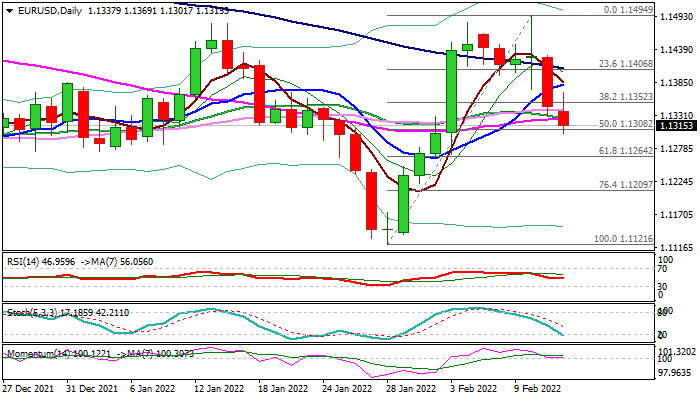

Bears tighten grip but need close below 1.1300 zone for confirmation

The Euro extends a steep fall into second day, following Friday’s 0.7% drop that completed a Doji reversal pattern on a daily chart.

Bears emerged below the daily cloud base (1.1316) and cracked pivotal Fibo support at 1.1308 (50% retracement of 1.1121/1.1494 rally), with firm break here to add to negative signals and open way for deeper drop.

Weakening technical studies on daily chart (fading bullish momentum / MA’s turned to bearish setup / south-heading RSI below neutrality territory) support the action, but further signals needed to confirm.

Upticks are expected to offer better selling opportunities while the action stays below broken Fibo at 1.1352 (38.2%) with repeated close below here to maintain bearish stance.

Only return and close above 10DMA (1.1382) would neutralize and signal an end of pullback.

Res: 1.1352; 1.1369; 1.1382; 1.1406

Sup: 1.1300; 1.1264; 1.1221; 1.1209