Bitcoin awaits stronger near-term direction signal

Bitcoin pulled back on Friday after hitting new 2023 peak above 25000 on Thursday, as bulls lost traction on renewed hawkish tones from Fed which hint more rate hikes and probably at higher pace.

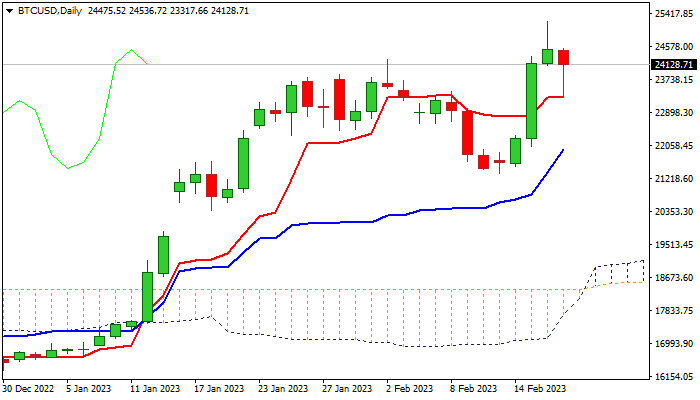

The price pulled back quickly after hitting new annual high (25226) on Thursday, signaling strong offers on daily candle with long upper shadow, but subsequent bearish acceleration on Friday, also proved to be short-lived.

Friday’s acceleration was contained by daily Tenkan-sen (23281) before strong bounce, which overall points to equilibrium of two opposite forces and keeping near-term price action without clear direction.

Technical studies on daily chart also lack direction signals as MA’s are in bullish setup, positive momentum turned sideways and stochastic is overbought.

This suggests that the price may hold in extended sideways mode and awaiting fresh direction signals.

More evidence that Fed’s latest hawkish rhetoric may materialize, would push Bitcoin’s price lower on expectations for fresh acceleration in Fed’s tightening cycle.

Conversely, signals that the US central bank is unlikely to change its current relaxed approach to the monetary policy would offer fresh support to Bitcoin.

Res: 24536; 25000; 25226; 27981

Sup: 23740; 23281; 22822; 22254