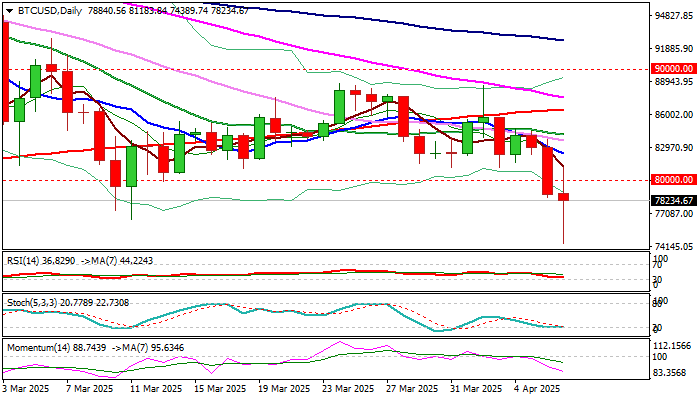

Bitcoin struggles to regain traction after being hit by risk aversion and fell to the lowest in five months

Bitcoin bounced from new five-month low on Monday after broader risk aversion on fears from tariff impact, also deflated cryptos.

Fresh strength cracked psychological 80K resistance, but firm break higher is required to offset negative signal from last week’s close below this level.

Otherwise, near-term focus will remain shifted to the downside as technical studies are bearish on daily chart and fundamentals continue to weigh (economic slowdown and higher inflation as the major negative consequences of trade war escalation).

Bears eye pivotal support at 73618 (Fibo 38.2% of 15437/109582) violation of which would further weaken near term structure and expose psychological 70K support.

Conversely, close above 80K would ease immediate downside pressure however, more work at the upside will be still required to verify initial positive signal.

Res: 80000; 81183; 82479; 84144

Sup: 76550; 74389; 73618; 70000