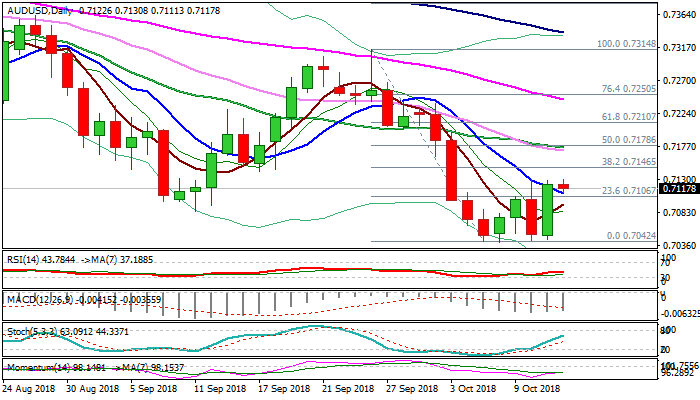

Break above 0.7146 Fibo barrier needed to signal reversal

The Aussie is consolidating in early Friday’s trading, following previous day’s strong rally when Australian dollar advanced 1%, as the greenback fell further after weaker than expected US CPI data.

Fresh bullish acceleration retested highs of recent congestion (0.7130) but was so far unable to break higher.

Fresh bulls were impacted by positive data from China (Sep trade surplus with the US hit the record high), but positive outlook exists.

Multiple downside rejection formed a base at 0.7042, with subsequent bullish acceleration which broke above falling 10SMA (currently at 0.7110) are supportive factors, along with strengthening momentum and north-heading slow stochastic on daily chart.

Bullish scenario requires extension and close above 0.7146 (Fibo 38.2% of 0.7314/0.7042) for confirmation reversal and bullish signal for recovery extension.

Res: 0.7130; 0.7146; 0.7178; 0.7210

Sup: 0.7110; 0.7085; 0.7042; 0.7000