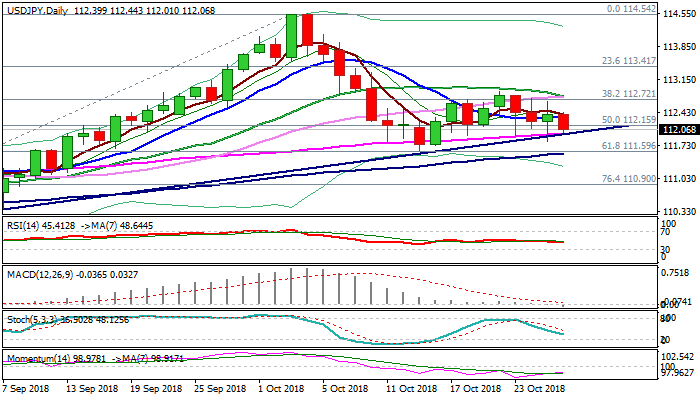

Break below key supports at 112 zone to provide bearish signal

The Japanese yen advanced on risk aversion in early Friday’s trading and tests again key supports at 112.00 zone (trendline support / 55SMA) which so far resisted several attacks.

Despite fresh weakness, mixed daily techs do not provide firmer direction signal, with close below 55SMA / trendline, needed weaken near-term structure for test of key supports at 111.62/56 (15 Oct low / Fibo 61.8% of 109.77/114.54 / rising 100SMA).

Sustained break here would provide stronger signal for continuation of bear-leg from 114.54 (03/04 Oct highs).

The pair is on track for bearish weekly close and form bearish engulfing pattern on weekly chart, which would generate negative signal.

Broken 10SMA (112.32) is expected to cap and maintain negative bias, while break higher would ease pressure.

Bounce above 112.78 (converged 20/30SMA) would neutralize bears and shift focus higher.

Res: 112.32; 112.44; 112.78; 112.88

Sup: 112.00; 111.81; 111.56; 110.90