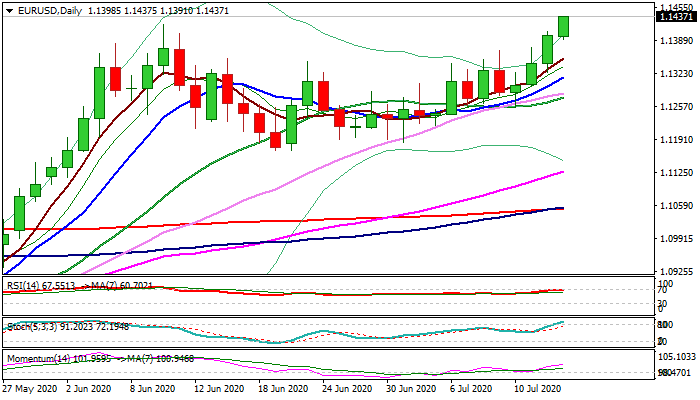

Break of 1.1422 barrier exposes 2020 high; potential dips to offer opportunity for re-entering bullish market

The Euro cracked June high (1.1422) and hit new four-month high in early Wednesday’s trading.

Hopes that EU leaders will agree on recovery plan in the summit (17/18 July) and SNB’s intervention this week, inflate the single currency.

Bulls look for clear break of 1.1422 barrier that would open way towards 1.1500 zone (2020 high at 1.1495, posted on 9 Mar).

Stronger bullish acceleration may look for test of 1.1595 (50% retracement of 1.2555/1.0635 2018/20 fall) and possible extension towards 1.1822 (Fibo 61.8%).

Rising positive momentum and daily MA’s in bullish setup (100/200DMA golden cross was formed yesterday) underpin the advance, but overbought stochastic warns that bulls may take a breather before resuming.

Dip-buying remains favored above 1.1350 support zone, while extension below rising 10DMA (1.1315) would sideline bulls and warn of deeper pullback.

Res: 1.1482; 1.1519; 1.1579; 1.1616

Sup: 1.1422; 1.1391; 1.1350; 1.1315