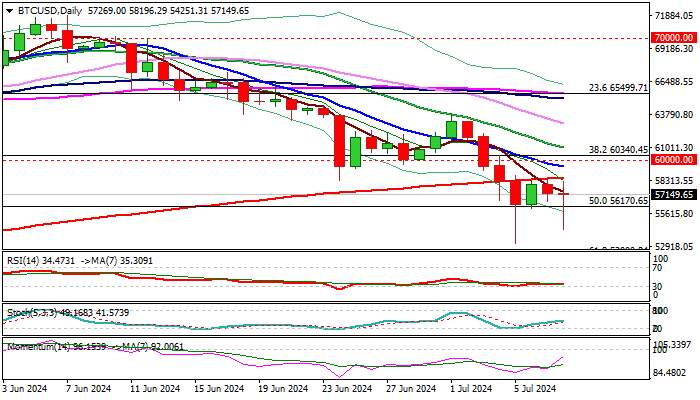

BTCUSD – larger bears are taking a breather, consolidation capped by 200DMA

Larger bears are pausing for consolidation for the fourth straight day, holding above the lowest levels since late February.

Technical picture on daily chart remains firmly bearish, with consolidation being capped by 200 DMA, converging with falling 10DMSA, in attempts to form a death cross and add to bearish structure.

However, long tails of recent daily candles point to strong bids which partially offset bearish pressure and keep the price in extended sideways mode.

Near-term action should ideally remain capped by 200DMA (58527) with extended upticks not to exceed psychological 60K barrier to keep bears in play and offer better levels tore-enter bearish market.

Violation of recent spike lows to open way for extension towards next targets at 52K and 50K (Fibo 61.8% of 38501/73839 upleg / psychological) respectively.

Res: 58528; 59458; 60000; 60340

Sup: 56450; 56170; 54251; 53142