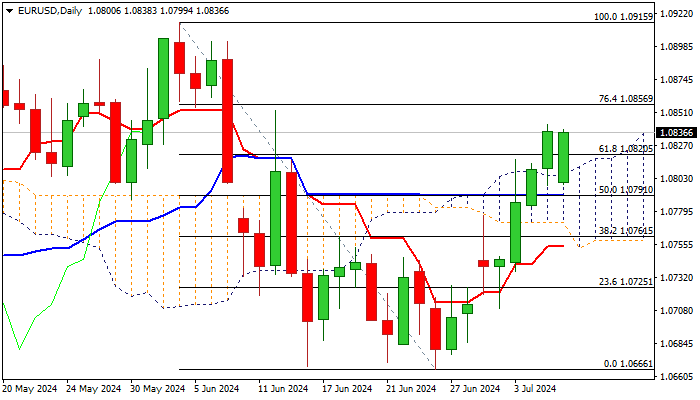

EURUSD – bullish bias above daily cloud

EURUSD opened with gap-lower on Monday but dip was short-lived and larger bulls regained control and pushed the price towards last Friday’s new multi-week high (1.0842).

Today’s dip was contained by psychological 1.0800 support (also the top of rising hourly cloud) with subsequent move higher emerging above the top of daily Ichimoku cloud after a shallow penetration.

Near-term bias is expected to remain with bulls as long as the price holds above daily cloud, with repeated daily close above broken Fibo level at 1.0820 (61.8% of 1.0915/1.0666) to reinforce positive near-term outlook.

Last week’s almost 0.9% advance also contributes to developing signals, as daily studies are bullish however, overbought conditions may obstruct bulls and keep the price in prolonged consolidation.

On the other hand, fundamentals are not so bright, as recent economic data showed that performance in bloc’s core industrial sector is still slow (particularly in Germany (EU’s largest economy) which may prompt the ECB to cut rates sooner or more than expected, which would be a negative signal for euro.

Res: 1.0842; 1.0856; 1.0900; 1.0919

Sup: 1.0820; 1.0800; 1.0777; 1.0756