Bulls approach psychological 1.30 barrier; Fed eyed for fresh signals

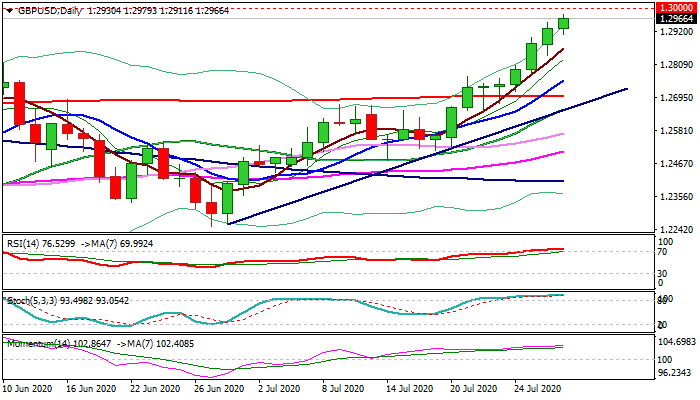

Cable extends steep bull-leg into ninth consecutive day and cracks barriers at 1.2970/76 (weekly cloud top /11 Mar high) the last obstacles on the way to psychological 1.30 resistance.

Fresh weakness of the dollar in expectations of dovish Fed, push the pound further up and exposed targets at 1.3000/17 (round-figure / Fibo 76.4% 1.3514/1.1409), break of which would generate strong bullish signal.

On the other side, the risk of failure at 1.30 zone rises as daily studies are overbought and psychological barriers usually provide strong headwinds for bulls.

Traders await comments from Fed chief Powell about steep fall of the dollar, as his response could influence greenback’s performance.

Cable may pull back if dollar regains traction on Powell’s speech, but under current circumstances, dips are likely to be limited and provide better levels to re-enter bullish market.

Firmly dovish Fed, which is widely expected scenario, could push pound through 1.3000/17 pivots that would expose peaks at 1.3199 (9 Mar) and 1.3209 (2020 high, posted on 31 Jan).

Res: 1.2979; 1.3000; 1.3017; 1.3050

Sup: 1.2952; 1.2911; 1.2862; 1.2838